Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

Blog Article

6 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

Table of ContentsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Things To Know Before You BuyThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsRumored Buzz on Mileagewise - Reconstructing Mileage LogsThe Buzz on Mileagewise - Reconstructing Mileage LogsThe Basic Principles Of Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs - Truths

Timeero's Fastest Distance attribute suggests the shortest driving route to your workers' destination. This feature boosts efficiency and contributes to cost savings, making it a necessary possession for organizations with a mobile labor force. Timeero's Suggested Path function better enhances responsibility and efficiency. Staff members can contrast the suggested route with the actual route taken.Such a method to reporting and conformity simplifies the usually intricate job of handling mileage costs. There are numerous benefits linked with making use of Timeero to maintain track of mileage.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

With these devices in usage, there will certainly be no under-the-radar detours to increase your repayment costs. Timestamps can be located on each gas mileage access, enhancing reliability. These added verification steps will certainly keep the internal revenue service from having a factor to object your mileage documents. With exact gas mileage tracking technology, your employees don't have to make harsh mileage quotes or also stress over gas mileage expenditure monitoring.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all cars and truck expenses. You will certainly need to continue tracking mileage for work even if you're utilizing the actual expenditure method. Keeping gas mileage records is the only method to separate service and individual miles and provide the evidence to the internal revenue service

Most gas mileage trackers allow you log your trips by hand while determining the range and reimbursement amounts for you. Several additionally come with real-time trip monitoring - you need to start the app at the begin of your journey and stop it when you reach your last location. These apps log your beginning and end addresses, and time stamps, together with the total distance and reimbursement amount.

Examine This Report about Mileagewise - Reconstructing Mileage Logs

One of the inquiries that The INTERNAL REVENUE SERVICE states that car expenses can be taken into consideration as an "regular and necessary" expense throughout operating. This consists of prices such as gas, maintenance, insurance coverage, and the car's depreciation. Nonetheless, for these expenses to be considered deductible, the car must be used for company objectives.

Some Known Factual Statements About Mileagewise - Reconstructing Mileage Logs

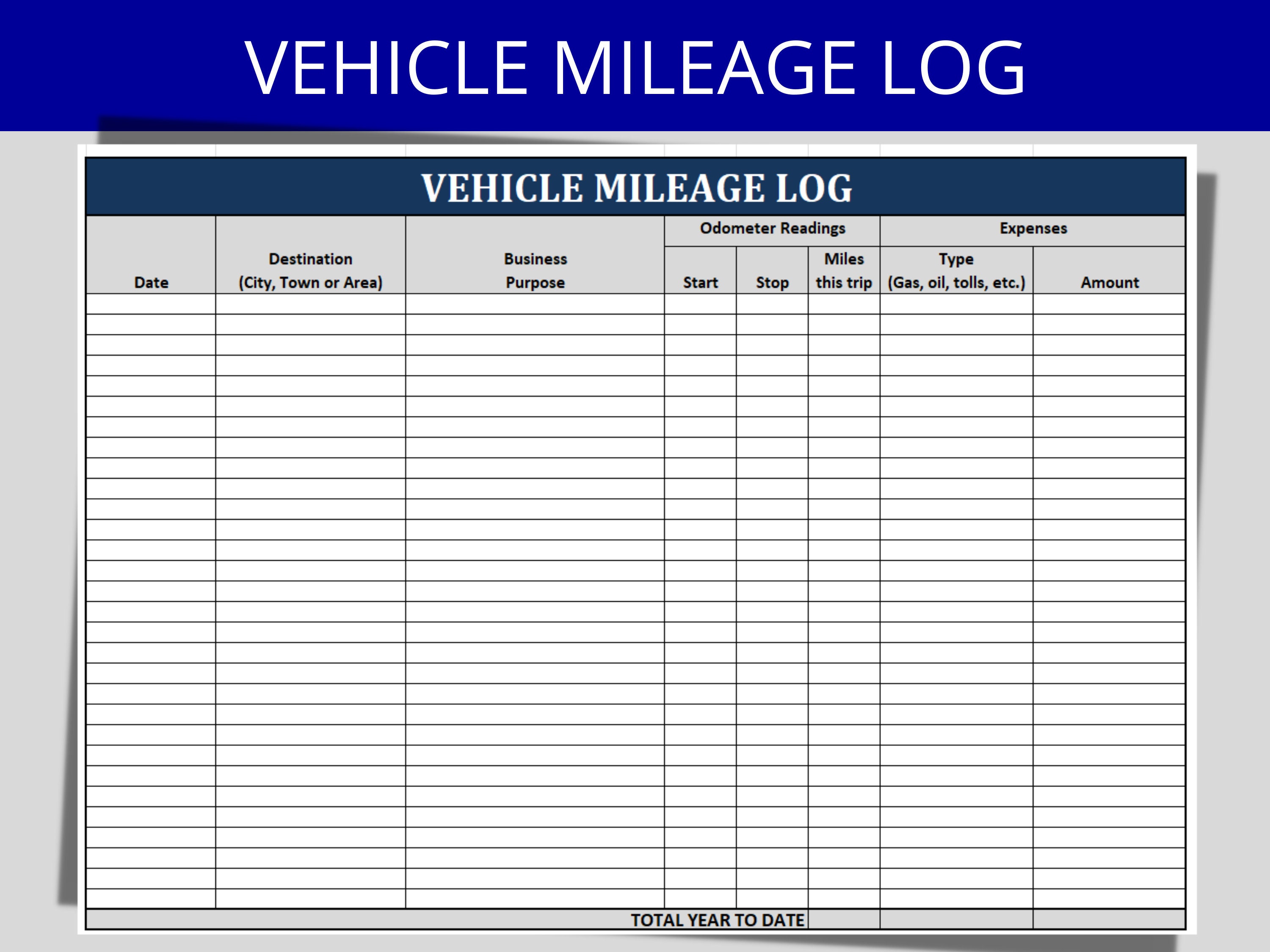

In between, faithfully track all your business trips keeping in mind down the beginning and finishing readings. For each trip, document the area and business function.

This consists of the total company mileage and overall mileage accumulation for the year (service + individual), journey's day, destination, and purpose. It's vital to tape activities promptly and preserve a coeval driving log detailing day, miles driven, and organization purpose. Right here's just how you can enhance record-keeping for audit functions: Beginning with making certain a precise gas mileage log for all business-related travel.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

The real expenses technique is an alternative to the basic gas mileage price method. Rather than calculating your reduction based upon a predetermined price per mile, the real expenses technique permits you to subtract the actual costs connected with using your automobile for company functions - mile tracker app. These costs include gas, maintenance, repair services, insurance, devaluation, and other associated costs

Those with considerable vehicle-related expenses or special problems hop over to these guys may profit from the actual costs technique. Please note electing S-corp status can alter this estimation. Inevitably, your selected technique ought to align with your certain economic objectives and tax scenario. The Standard Mileage Rate is a measure provided every year by the IRS to establish the deductible costs of running a car for business.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

(https://padlet.com/tessfagan90/my-sweet-padlet-o4pk9ieoiku5vd1j)Calculate your complete organization miles by utilizing your beginning and end odometer analyses, and your recorded service miles. Properly tracking your precise mileage for business trips aids in corroborating your tax reduction, specifically if you decide for the Standard Gas mileage method.

Keeping track of your gas mileage by hand can require persistance, yet bear in mind, it could conserve you money on your taxes. Tape-record the complete mileage driven.

Get This Report about Mileagewise - Reconstructing Mileage Logs

And now almost everyone uses General practitioners to get around. That suggests virtually everybody can be tracked as they go regarding their service.

Report this page