Mileagewise - Reconstructing Mileage Logs - An Overview

Mileagewise - Reconstructing Mileage Logs - An Overview

Blog Article

See This Report about Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs6 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown7 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedExcitement About Mileagewise - Reconstructing Mileage LogsEverything about Mileagewise - Reconstructing Mileage LogsGetting My Mileagewise - Reconstructing Mileage Logs To WorkThe Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Distance function suggests the quickest driving path to your employees' destination. This function boosts efficiency and adds to cost financial savings, making it a necessary property for businesses with a mobile workforce. Timeero's Suggested Course feature better boosts responsibility and performance. Workers can contrast the suggested course with the real route taken.Such a method to reporting and compliance simplifies the typically complicated task of managing mileage expenditures. There are lots of benefits connected with utilizing Timeero to keep track of gas mileage.

10 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

With these tools being used, there will certainly be no under-the-radar detours to boost your compensation prices. Timestamps can be discovered on each gas mileage entry, increasing reputation. These added verification procedures will keep the internal revenue service from having a reason to object your gas mileage records. With accurate mileage monitoring innovation, your employees don't have to make harsh mileage price quotes and even fret about gas mileage expense tracking.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all car expenses (free mileage tracker). You will certainly require to proceed tracking gas mileage for job also if you're using the real expenditure technique. Maintaining gas mileage documents is the only way to different business and personal miles and offer the evidence to the internal revenue service

Most mileage trackers allow you log your trips by hand while computing the range and compensation quantities for you. Numerous also featured real-time journey tracking - you require to start the application at the beginning of your journey and stop it when you reach your last destination. These applications log your beginning and end addresses, and time stamps, along with the overall range and reimbursement amount.

Not known Facts About Mileagewise - Reconstructing Mileage Logs

This includes prices such as gas, maintenance, insurance policy, and the lorry's depreciation. For these prices to be taken into consideration deductible, the car needs to be made use of for company functions.

Rumored Buzz on Mileagewise - Reconstructing Mileage Logs

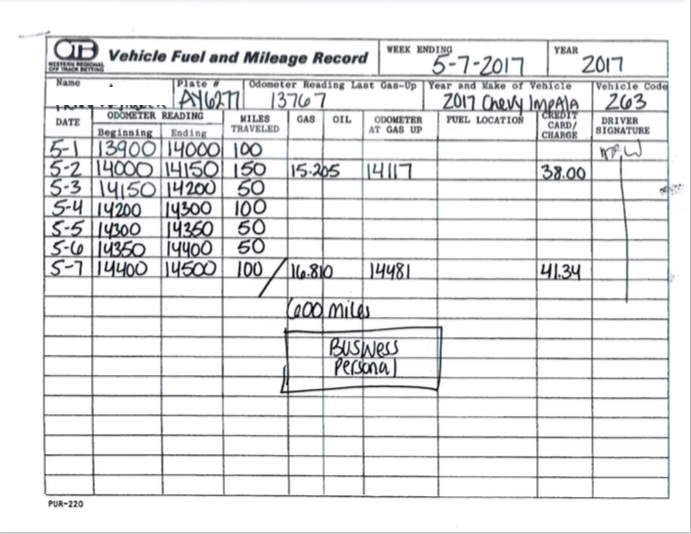

Beginning by recording your vehicle's odometer analysis on January 1st and afterwards once more at the end of the year. In between, faithfully track all your business trips taking down the starting and finishing analyses. For each journey, document the place and company purpose. This can be streamlined by maintaining a driving visit your vehicle.

This includes the overall organization gas mileage and total gas mileage buildup for the year (business + personal), journey's date, location, and purpose. It's vital to videotape activities without delay and maintain a contemporaneous driving log describing date, miles driven, and service purpose. Right here's just how you can improve record-keeping for audit functions: Beginning with guaranteeing a thorough mileage log for all business-related travel.

The Mileagewise - Reconstructing Mileage Logs Ideas

The real expenditures technique is a different to the basic mileage rate method. Rather than determining your reduction based on a predetermined rate per mile, the actual expenditures approach allows you to deduct the real prices linked with using your car for company functions - free mileage tracker app. These expenses include fuel, upkeep, repair services, insurance coverage, depreciation, and other relevant costs

Those with significant vehicle-related costs or distinct conditions might benefit from the real expenditures technique. Please note choosing S-corp status can transform this estimation. Eventually, your selected method must line up with your specific financial objectives and tax scenario. The Criterion Mileage Price is a step released yearly by the IRS to establish the deductible costs of operating a car for company.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

(https://giphy.com/channel/mi1eagewise)Whenever you use your cars and truck for organization journeys, tape-record the miles traveled. At the end of the year, once again write the odometer analysis. Compute your overall service miles by utilizing your begin and end odometer readings, and your videotaped company miles. Accurately tracking your exact mileage for service trips aids in validating your tax reduction, particularly if you choose the Criterion Gas mileage method.

Keeping track of your mileage manually can need diligence, however keep in mind, it can conserve you cash on your taxes. Videotape the complete mileage driven.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

And now nearly every person utilizes General practitioners to obtain around. That means virtually everyone can be tracked as they go regarding their business.

Report this page